Is the peace of mind offered by TurboTax Max genuinely worth the additional expense when navigating your annual tax obligations? For many, the prospect of an IRS audit or the nightmare of identity theft is enough to cause sleepless nights. TurboTax Max aims to soothe those anxieties, bundling services designed to protect you long after your return is filed. But before you click "add to cart," let's thoroughly unpack the TurboTax Max Features & Benefits Explained to see if this optional add-on truly aligns with your needs and budget.

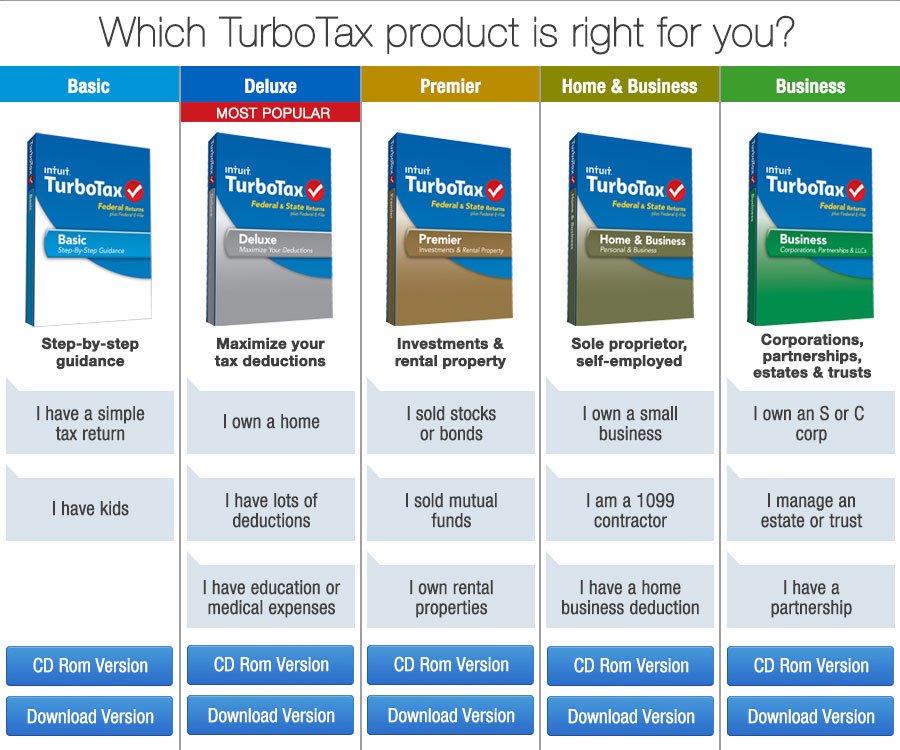

Navigating tax software can feel like choosing between a handful of good options, each with its own promise of simplicity and savings. TurboTax stands out for its user-friendly interface and step-by-step guidance, but understanding the tiered offerings and add-ons like MAX is key to avoiding unnecessary costs. This isn't just about filing your taxes; it's about safeguarding your financial future.

At a Glance: TurboTax Max Essentials

- What it is: An optional add-on for paid TurboTax Online editions (Deluxe, Premier, Self-Employed).

- Cost: Typically ranges from $49-$69, on top of your chosen TurboTax edition.

- Core Offerings: Full audit representation, identity theft insurance, full identity restoration, identity theft monitoring, and priority customer care.

- Key Consideration: Functions like an insurance policy, providing significant value if an audit or identity theft event occurs, despite these being statistically rare.

- When to Add: Must be purchased before filing your tax return; it is non-refundable.

- Who Benefits: Primarily those with complex returns, high incomes, or anyone seeking extensive post-filing protection and peace of mind against audits or identity fraud.

What Exactly Is TurboTax Max? Unpacking the Optional Add-On

Think of TurboTax Max not as part of the core tax preparation software, but as a specialized "insurance policy" for your tax season and beyond. It's an optional add-on, meaning it doesn't come standard with any TurboTax product. Instead, it's offered as an upgrade for users of paid TurboTax Online editions—specifically Deluxe, Premier, and Self-Employed.

The price tag for this peace of mind typically falls in the range of $49 to $69, added directly onto the cost of your chosen TurboTax edition. While this might seem like a small fee, it's crucial to understand what you're getting for that investment. The services included with MAX are designed to kick in after you've filed your return, addressing two significant post-filing concerns: potential IRS audits and the ever-present threat of identity theft.

A critical detail to remember: MAX is non-refundable once paid, and you must add it to your cart and pay for it before you complete and file your tax return. Unlike some features you can retroactively apply, MAX is a pre-filing commitment. For a deeper dive into whether this add-on makes sense for your specific situation, you might want to explore the question, Is TurboTax Max worth it?.

Beyond the Basics: Diving into MAX's Core Features

Now, let's break down the individual components of TurboTax Max. Each feature addresses a distinct risk, offering a layer of protection that goes beyond the standard tax filing experience.

Full Audit Representation: Your IRS Shield

Perhaps the most compelling feature of TurboTax Max is its promise of "Full Audit Representation." For many taxpayers, receiving a letter from the IRS detailing an audit can trigger immediate panic. The tax code is complex, and navigating an audit process alone can be daunting, time-consuming, and potentially costly if mishandled.

With MAX, if you're selected for an IRS audit, a dedicated tax expert will step in to represent you. This isn't just about answering a few questions; it means a professional will handle communications with the IRS on your behalf, develop an action plan, help you gather necessary documents, and represent your interests throughout the entire process. This can be an invaluable service, especially if your tax situation is complex or if you lack confidence in dealing directly with government agencies. While the statistical likelihood of an IRS audit is low for most taxpayers (typically less than 1% for individual returns), the stress and potential financial impact of even a minor audit can be immense. Having a professional in your corner can transform a terrifying ordeal into a manageable process.

Identity Theft Protection & Restoration: Safeguarding Your Financial Self

In an increasingly digital world, identity theft remains a pervasive threat. From sophisticated phishing scams to data breaches, personal financial information is constantly at risk. TurboTax Max offers a multi-faceted approach to this challenge:

- Identity Theft Insurance: This provides reimbursement up to $250,000 for out-of-pocket expenses directly related to identity theft. Additionally, it offers up to $1 million in legal fees and expenses, which can be crucial given the potential legal complexities of restoring your identity.

- Full Identity Restoration: If identity fraud does occur, you won't be left to navigate the aftermath alone. MAX provides assistance to help you restore your identity to its pre-theft status. This often involves filing disputes, contacting credit bureaus, and working with various institutions—a process that can be incredibly time-consuming and frustrating without expert guidance.

- Identity Theft Monitoring: Prevention is often better than cure. This feature actively monitors for suspicious online activity related to your identity. If potential threats are detected, you'll be notified, and a resolution specialist will help you understand the activity and respond appropriately. This proactive vigilance can help you catch potential issues before they escalate into full-blown identity theft.

Considering that tax-related identity theft is a common tactic for criminals, and the long-term impact of identity theft can be severe, this suite of protections offers a robust safety net.

Priority Care: Skip the Line for Expert Help

During peak tax season, getting timely support from any customer service can be a challenge. TurboTax Max includes "Priority Care," granting you priority access to a TurboTax specialist. This means less time waiting on hold and quicker resolutions to any questions or issues you might have, whether they're related to your tax return or the MAX services themselves. While seemingly a minor perk, anyone who has spent frustrating hours waiting for support understands the true value of priority access during stressful times.

MAX vs. TurboTax Live: Understanding Different Support Levels

It's easy to confuse the various support and add-on options TurboTax offers. A common point of confusion arises between TurboTax Max and TurboTax Live. Let's clarify the distinction:

- TurboTax Live: This service connects you with a real tax expert (CPA or Enrolled Agent) during the tax preparation process. They can answer your questions, review your return before you file, or even prepare and file your return for you. It's about getting expert help with the actual filing of your taxes.

- TurboTax Max: As we've discussed, MAX is primarily about post-filing protection. It offers audit defense and identity theft services that activate after your return has been submitted. It does include priority care, which provides faster access to a specialist, but it's not the same as having an expert actively help you prepare your return.

In essence, TurboTax Live assists you before and during filing, ensuring your return is accurate and optimized. TurboTax Max protects you after filing from potential issues like audits or identity theft. Both are optional add-ons, and their costs are separate. You could theoretically purchase both, depending on your needs.

Who Really Benefits from TurboTax Max? Identifying Your Needs

Deciding whether TurboTax Max is a worthwhile investment boils down to your individual tax situation, your risk tolerance, and the value you place on peace of mind. While the statistical likelihood of an audit or identity theft may be low, the consequences can be significant.

Consider MAX if you fall into one or more of these categories:

- You Have a Complex Tax Situation: If your tax return involves more than just a W-2—think self-employment income (1099s), extensive itemized deductions, rental properties, significant investment income, or foreign income—your return inherently has a higher perceived audit risk by the IRS. While still rare, the complexity means more areas for potential scrutiny.

- You're a High-Income Earner: Historically, higher-income individuals (especially those earning $200,000 or more) face a slightly elevated audit rate compared to lower and middle-income taxpayers. If you fit this demographic, MAX might offer a greater sense of security.

- You Value Utmost Peace of Mind: For some, the mere thought of an audit is enough to cause significant stress. Knowing that a professional will handle any IRS communications on your behalf can be a huge psychological relief, regardless of the statistical probability. The same applies to identity theft concerns.

- You're New to Complex Tax Scenarios: Perhaps you've recently started a side hustle, bought an investment property, or inherited assets that complicate your taxes for the first time. Navigating these new complexities can be daunting, and the added layer of audit protection can be reassuring.

- You're Generally Concerned About Identity Theft: Beyond taxes, if you're someone who is already proactive about digital security and wary of online threats, the comprehensive identity theft protection offered by MAX might align with your broader security strategy.

For individuals with very simple tax returns (e.g., a single W-2, no dependents, standard deduction), the added cost of TurboTax Max is likely overkill. Their audit risk is extremely low, and the need for extensive identity theft protection specifically tied to their tax filing may not outweigh the cost.

Making the Call: When Might MAX Be Worth the Extra Cost?

The decision to purchase TurboTax Max is a personal one, weighing potential risks against a tangible cost. Here's a framework to help you make an informed choice:

- Assess Your Audit Risk Profile:

- Low Risk: Single W-2, standard deduction, no significant investments, low income. MAX is likely unnecessary.

- Medium Risk: Itemized deductions, some investment income, student loan interest, moderate income. Consider your comfort level with handling potential IRS inquiries yourself.

- High Risk: Self-employed with significant income/deductions, rental properties, foreign income, high income bracket. MAX's audit representation becomes more appealing.

- Evaluate Your Identity Theft Concerns:

- Are you generally at a higher risk due to recent data breaches you were part of?

- Do you have a history of identity theft attempts?

- How much value do you place on having professional help for restoration and ongoing monitoring?

- Consider the Cost vs. Potential Savings/Protection:

- The $49-$69 fee is relatively small compared to the thousands of dollars an expert auditor or identity theft recovery service might cost if you had to hire them independently.

- However, if you're highly unlikely to use the services, that $49-$69 could be put towards other financial goals.

- Value of Peace of Mind: This is subjective but powerful. If the assurance of expert help for audits and identity theft allows you to sleep better at night, the cost might be a worthy investment in your mental well-being.

How to Add TurboTax Max

If you decide MAX is right for you, adding it is straightforward:

- During Tax Preparation: As you prepare your return, TurboTax will typically offer you the option to add MAX during various stages, especially before you reach the final review and filing steps.

- Via the Review Section: If you've passed the initial offer, you can usually add MAX by opening your tax return, selecting "Review" from the left navigation menu, scrolling to the "MAX" screen, and choosing "Get MAX." Remember, this must be done before you've officially filed your return.

The Fine Print: What MAX Doesn't Cover or Key Considerations

Understanding what MAX does is important, but knowing its limitations is equally crucial for setting realistic expectations.

- It's Not a Shield Against Audit Selection: MAX doesn't prevent you from being selected for an audit. Its value kicks in after an audit notice is received, providing representation rather than prevention.

- Non-Refundable Policy: Once purchased, the MAX fee is non-refundable. There's no trying it out and getting your money back if you change your mind later or realize you don't need it.

- No Tax Advice During Filing: While MAX includes priority care for TurboTax specialists, it doesn't provide a tax expert to review or prepare your return, which is what TurboTax Live offers. MAX's primary function is post-filing defense and identity theft protection.

- Limited to TurboTax Online: MAX is specifically an add-on for paid TurboTax Online editions. If you use the desktop software, this particular MAX offering isn't applicable.

- It's Insurance, Not a Guarantee: Identity theft protection and audit representation are like insurance. You hope you never need them, but they're there if you do. The benefits are contingent on an actual event occurring.

For those considering any of TurboTax's offerings, it's always wise to assess your specific tax situation to determine if higher-tier upgrades or expert help are truly needed, potentially avoiding unnecessary costs. TurboTax can indeed streamline tax filing, provided you select the appropriate version and add-ons for your unique needs.

Beyond MAX: General TurboTax Features That Can Maximize Your Return

While our focus has been on TurboTax Max, it's worth briefly touching on some of the core features that make TurboTax a popular choice for tax preparation, as these contribute to the overall user experience and value proposition. These general features are part of the broader TurboTax ecosystem and can help you maximize your refund and minimize errors, whether or not you opt for MAX.

- Document Import: A significant time-saver, TurboTax allows you to import W-2s, 1099s, and investment income reports directly from many financial institutions. This not only streamlines data entry but also helps reduce transcription errors.

- Deduction Maximizer: This tool scans your input for eligible deductions and credits you might otherwise miss, such as mortgage interest, student loan interest, or charitable contributions. While it can prompt upgrades, its primary benefit is identifying potential tax savings.

- User-Friendly Interface: TurboTax is renowned for its step-by-step guidance, translating complex tax jargon into plain language. This makes the filing process less intimidating for individuals with varying levels of tax knowledge.

- Accuracy Guarantee: TurboTax offers an accuracy guarantee, promising to pay IRS penalties and interest if their software makes a calculation error. This provides a baseline level of assurance for all users.

- Cloud Data Storage: For online users, your tax data is stored securely in the cloud, allowing you to access and work on your return from any internet-connected device.

These features collectively aim to simplify the filing process, maximize your refund, and minimize errors. However, it's important to remember that not all versions are free, and state tax returns usually incur an additional fee. Carefully assessing your specific tax situation remains paramount to selecting the right TurboTax product.

Weighing the Scales: Is MAX the Right Fit for Your Tax Season?

Ultimately, the question "Are TurboTax Max Features and Benefits Worth the Cost?" doesn't have a universal answer. It hinges on your individual circumstances, financial comfort, and attitude towards risk.

If you have a straightforward tax return and aren't particularly concerned about audit risks or identity theft, the additional $49-$69 for MAX might be an expenditure you can comfortably skip.

However, if your taxes are complex, involve self-employment or significant investments, or if you simply value the psychological comfort of knowing you have a dedicated expert on standby for an audit and robust protection against identity theft, then TurboTax Max offers a compelling package. It’s an investment in peace of mind and professional support should the unlikely occur.

Before making your final decision, take a moment to reflect:

- How complex is your tax situation this year?

- How would you cope emotionally and financially if you received an audit notice?

- How concerned are you about identity theft in today's digital landscape?

By answering these questions honestly, you'll be well-equipped to decide if TurboTax Max is the valuable addition your tax strategy needs, ensuring you file your taxes with confidence and a secure outlook for the year ahead.