When you’re staring down the final steps of filing your taxes, the last thing you want is another decision to make. Yet, for many TurboTax users, an optional add-on pops up: TurboTax MAX. At first glance, it promises audit defense and identity theft protection, but is this extra cost truly a wise investment? This comprehensive guide dives deep into TurboTax Max Pricing & Value Analysis, helping you cut through the marketing jargon to understand exactly what you're getting, what you’re not, and whether it’s genuinely worth the additional expense for your unique financial situation.

Let's face it: the idea of an IRS audit sends shivers down most people's spines, and identity theft is an ever-present modern fear. TurboTax MAX aims to ease those anxieties, but its value isn't universal. Understanding its features, limitations, and how it aligns with your personal risk profile is key to making an informed decision.

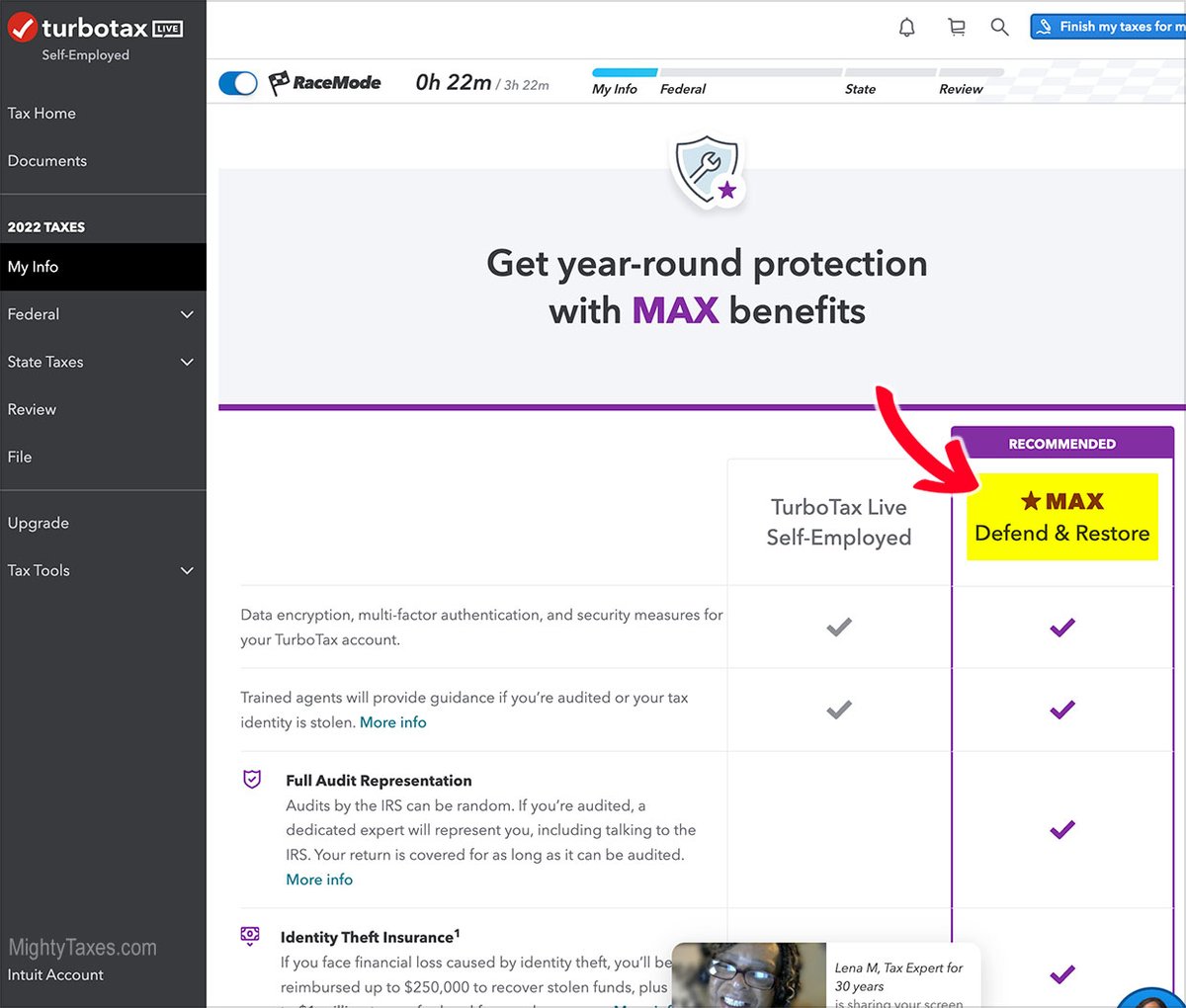

At a Glance: TurboTax MAX Essentials

Before we unravel the details, here’s a quick overview of what TurboTax MAX offers:

- Audit Representation: A dedicated tax expert handles all communications and documentation with the IRS on your behalf if you're audited.

- Identity Theft Protection: Includes up to $250,000 for direct financial losses and $1 million for legal fees related to identity theft.

- Identity Restoration & Monitoring: Assistance in restoring your identity and alerts for suspicious online activity.

- Priority Care: Faster access to TurboTax specialists for support.

- Cost: Typically ranges from $49 to $69, an add-on to TurboTax Deluxe, Premier, or Self-Employed Online.

- Coverage: Applies to the specific tax year it was purchased for and must be bought before filing.

- Key Distinction: Goes beyond basic "Audit Support Guarantee" by providing full representation, not just guidance.

Beyond the Basics: What TurboTax MAX Actually Is (and Isn't)

TurboTax MAX isn't a standalone product; it's an optional, premium service bundle designed to layer on top of specific TurboTax online editions. Think of it as an insurance policy for your tax filing. When you're using TurboTax Deluxe, Premier, or Self-Employed Online, you'll encounter the option to add MAX, usually priced between $49 and $69. This cost is in addition to your chosen TurboTax edition fee, making your total tax preparation cost higher.

But what exactly are you buying into for that extra fee? In essence, you're investing in peace of mind across two primary areas: dealing with the IRS in an audit, and recovering from the devastating impact of identity theft. However, it's crucial to understand the specifics because the term "protection" can sometimes be misleading if you don't grasp the scope of what's covered.

You can add MAX during your tax preparation process, typically via the "Review" menu, but a critical point is that it must be purchased before you file your tax return. Once paid, it's non-refundable and applies only to the tax year for which you bought it. This means if you buy MAX for your 2023 taxes, it won't cover any issues that arise from your 2022 or 2024 filings.

The "Insurance" Analogy: A Double-Edged Sword

Many people view TurboTax MAX as a form of insurance, and that's a fair comparison. Like any insurance, you pay a premium for protection against statistically rare but potentially costly events. The challenge lies in determining if the premium is justified by the perceived risk and the quality of the protection offered. For many, deciding if TurboTax Max is worth it boils down to a personal risk assessment.

A Deep Dive into MAX's Core Benefits

Let's break down the specific components of TurboTax MAX to understand their potential value.

Audit Representation: Your Personal Tax Shield

This is arguably the most compelling feature of TurboTax MAX for many users. If the IRS decides to audit your tax return for the year you purchased MAX, you won't have to face them alone.

- Full Representation: Unlike the basic Audit Support Guarantee (which merely offers guidance), MAX provides a dedicated, licensed expert who will represent you fully. This professional steps in as your advocate, developing an action plan, handling all communications with the IRS, and preparing any necessary IRS documents on your behalf. You are essentially delegating the stress and complexity of the audit process to someone experienced.

- Comprehensive Coverage: This representation lasts for the entire audit process—from the moment you receive the first IRS notice until the audit is officially completed. It's a significant relief for those who dread navigating IRS bureaucracy.

- Specific to IRS Audits: The coverage specifically refers to IRS audits. While many state tax departments often follow federal audit leads, MAX's explicit guarantee is for federal IRS audits.

- Exclusions: It's important to note that this service doesn't cover tax court proceedings. If an audit escalates beyond the administrative level to a court case, you'd need separate legal counsel. Also, it excludes very large businesses (gross receipts over $5 million or 10+ partners/stockholders).

Identity Theft Protection: Guarding Your Financial Self

In an age where data breaches are common, identity theft protection offers significant reassurance. TurboTax MAX bundles several services to help you if your identity is compromised.

- Identity Theft Insurance: This is a crucial financial safeguard. It provides reimbursement up to $250,000 for direct financial losses you incur due to identity theft. This could include unauthorized withdrawals, fraudulent purchases, or even lost wages from time spent resolving the issue. Beyond financial losses, it also offers up to $1 million for legal fees and expenses related to restoring your identity.

- Full Identity Restoration: If you experience identity fraud, a resolution specialist will assist you step-by-step in restoring your identity. This can involve notifying creditors, disputing fraudulent charges, and dealing with government agencies—a process that can be incredibly time-consuming and frustrating to tackle alone.

- Identity Theft Monitoring: Prevention is often better than cure. This service actively monitors for suspicious online activity related to your identity and notifies you of potential threats. Should an alert arise, a resolution specialist is available to help you respond quickly.

Priority Care: When Time is Money

While not as dramatic as audit defense or identity theft recovery, Priority Care is a practical benefit that can save you frustration. It grants you priority access to a TurboTax specialist. During peak tax season, wait times for customer support can be long. Having priority access means you're likely to get your questions answered and issues resolved faster, which can be invaluable when you're under a deadline or facing a complex tax query.

Crunching the Numbers: Is the MAX Price Tag Justified for You?

Understanding the benefits is one thing; assessing their value for you is another. Let's look at the hard facts and scenarios where TurboTax MAX might shine.

The Statistical Reality: Audits Are Rare

The good news is that IRS audits are statistically rare. In 2020, only about 0.3% of individual tax returns were audited. That's less than 1 in 300 returns. For the vast majority of taxpayers, particularly those with straightforward W-2 income and standard deductions, the risk of an audit is even lower.

This low probability is why TurboTax MAX is often viewed as an insurance product. You're paying for protection against an event that's unlikely to happen. The question then becomes: how much is that peace of mind worth to you?

Weighing Peace of Mind vs. Cost

For $49-$69, you're buying security. If the thought of dealing with the IRS fills you with dread, or if you've been a victim of identity theft before, this cost might feel like a bargain for the reassurance it provides. The potential financial and time costs of an audit or identity theft can be substantial, easily dwarfing the MAX fee.

Imagine spending dozens of hours preparing documents, responding to IRS notices, and navigating complex tax laws. An expert handling that for you could be worth far more than $69. Similarly, the financial and emotional toll of identity theft can be immense, making the insurance and restoration services attractive.

When Your Audit Risk Rises: Factors Increasing MAX's Potential Value

While overall audit rates are low, certain factors can increase your likelihood of an audit, making TurboTax MAX a more compelling consideration.

- High Earners & Complex Income: Individuals earning over $1 million annually or those with significant business income (especially sole proprietors earning six figures) face increased scrutiny. The IRS often targets these returns due to the higher potential for discrepancies or understated income.

- Sole Proprietors & Schedule C Filers: If you run your own business, even a small one, and report income and expenses on Schedule C, your return is inherently more complex and prone to audit. Deductions, business losses, and the classification of expenses are common areas of IRS focus. Unrealistic or sustained business losses, in particular, can be a red flag.

- Unusual or Large Deductions: Any deduction that appears disproportionate to your income or lifestyle can draw attention. For example, claiming very large charitable donations compared to your income, or significant home office deductions that seem out of sync with your profession, might increase your audit risk.

- Early Retirement Withdrawals: Taking distributions from retirement accounts (like a 401k or IRA) before age 59 ½ often incurs penalties and requires careful reporting. Errors in this area can trigger an IRS review.

- Discrepancies: Mismatches between information reported by third parties (like employers, banks, or brokers) on forms like W-2s, 1099s, and K-1s, and what you report on your return are immediate red flags for the IRS.

If any of these scenarios describe your tax situation, the additional protection offered by MAX, particularly the full audit representation, starts to look much more appealing. When you're assessing if TurboTax Max is worth it for your specific circumstances, consider these risk factors carefully.

Who Benefits Most from TurboTax MAX?

Let's look at some scenarios where TurboTax MAX really shines.

- The Anxious Filer: If the mere thought of an IRS letter makes your stomach clench, the peace of mind offered by full audit representation might be invaluable. You're essentially paying to offload that stress.

- Small Business Owners/Self-Employed Individuals: If you have complex income and expenses reported on Schedule C, your audit risk is higher than someone with a simple W-2. The potential for deductions to be questioned is greater, and having an expert on your side can save immense time and money. This is especially true if you're new to self-employment or have fluctuating income.

- Those with Significant Deductions/Credits: If your return includes substantial or unusual deductions, or complex tax credits, you might be more prone to an audit. MAX can provide a safety net.

- Individuals Who Value Time: Even if an audit is unlikely, dealing with one takes significant time. If your time is extremely valuable, outsourcing the audit process to a professional can be a sound investment.

- Anyone Concerned About Identity Theft: Beyond taxes, if you're generally concerned about identity theft and don't already have comprehensive protection, MAX's bundled identity services offer a robust layer of security.

For these individuals, the TurboTax Max Pricing & Value Analysis often tips in favor of purchasing the add-on.

Understanding the Limitations: What MAX Doesn't Cover

While powerful, TurboTax MAX isn't a silver bullet for all tax-related woes. It's crucial to be aware of its boundaries.

- No Tax Court Representation: If an audit escalates beyond the administrative level and the IRS decides to take you to tax court, MAX's audit representation does not extend to providing legal assistance for those proceedings. You would need to secure a separate tax attorney.

- Not a Tax Preparer or Advisor: MAX does not prepare or amend tax returns, handle bookkeeping, organize your records, or reconcile your checkbooks. It’s reactive protection against audits and identity theft, not proactive tax planning or ongoing financial management. Your primary responsibility remains filing an accurate return.

- Exclusions for Large Businesses: The audit defense portion of MAX has limitations for very large businesses, specifically those with gross receipts exceeding $5 million or having 10 or more partners, stockholders, beneficiaries, or members. This indicates it’s primarily designed for individual and smaller business tax situations.

- Single-Year Coverage: As mentioned, MAX applies only to the specific tax year for which it was purchased. It's not a subscription that covers all your past or future filings.

- Non-Refundable: Once you've paid for MAX, the fee is non-refundable, even if you never experience an audit or identity theft event.

- Not for Complex Tax Planning: For highly complex financial situations, international income, or intricate business structures, a dedicated Certified Public Accountant (CPA) or tax attorney may offer more comprehensive and personalized support that goes beyond what MAX provides. They can offer ongoing advice, proactive planning, and representation across a wider spectrum of issues.

Understanding these limitations helps you make a more realistic assessment of the value proposition. For someone needing deeper, ongoing tax support, MAX is not a substitute for professional advisory services.

Making the Call: Your Personal Value Assessment

So, after all this, how do you decide if TurboTax MAX is right for you? It boils down to a personal assessment of your situation, risk tolerance, and budget.

Consider these decision criteria:

- Your Tax Return Complexity: Do you have a simple W-2 return, or are you self-employed with multiple income streams, many deductions, and investments? The more complex your return, the higher your (even if still low) audit risk.

- Your Audit Anxiety Level: How much would an IRS audit or identity theft scenario impact your mental well-being? If the thought alone causes significant stress, the peace of mind might be worth the premium.

- Your Knowledge & Time: Do you feel confident navigating IRS correspondence and regulations on your own? Do you have the time to dedicate to an audit defense if one arises?

- Existing Protections: Do you already have comprehensive identity theft protection through another service (e.g., your bank, employer, or credit card)? If so, a significant portion of MAX's offering might be redundant.

- Your Budget: Is the $49-$69 an amount you're comfortable spending for this level of additional protection, or would that money be better allocated elsewhere?

- Your Financial Situation: Could you easily absorb the potential costs of an audit (e.g., hiring an independent tax professional) if one occurred without MAX?

If you have a very straightforward return with minimal deductions, your inherent audit risk is already quite low, and the identity theft protection might be redundant if you have other services. In such cases, the additional cost of MAX might not represent good value. However, if you fit the profile of a higher-risk filer or simply prioritize absolute peace of mind, the investment in MAX could be well-justified.

Frequently Asked Questions About TurboTax MAX

Let's tackle some common questions users have about TurboTax MAX.

Can I buy TurboTax MAX after I file my return?

No. TurboTax MAX must be purchased before you officially file your tax return for the specific tax year you want it to cover. Once your return is filed, you can no longer add MAX for that year.

Does TurboTax MAX cover state audits?

The explicit guarantee for audit representation within TurboTax MAX refers to IRS audits. While an IRS audit can sometimes trigger a state audit, and the defense expert might offer guidance, the core representation service is specifically for federal IRS issues. It's always best to clarify specific state coverage directly with TurboTax if that's a primary concern.

Is TurboTax MAX refundable if I don't use it?

No, TurboTax MAX is non-refundable once purchased. Like an insurance premium, you pay for the coverage, regardless of whether you end up needing to utilize the services.

Is TurboTax MAX the same as the Audit Support Guarantee included with all TurboTax products?

No, they are distinct. All TurboTax products (except Business) include an "Audit Support Guarantee," which provides free consultation and guidance to help you prepare for an audit. However, with this basic support, you are still responsible for representing yourself. TurboTax MAX's Audit Defense, by contrast, provides full representation by a licensed tax professional who will handle communications and documentation with the IRS on your behalf. This is a critical difference.

The Bottom Line: Investing in Confidence or Over-Insuring?

Ultimately, the decision to purchase TurboTax MAX comes down to your personal comfort level and risk assessment. For a typical filer with a simple W-2 income and standard deductions, the statistical likelihood of an audit is so low that the additional cost of MAX might feel like over-insuring. The basic Audit Support Guarantee, combined with the inherently low risk, might be sufficient.

However, for those with more complex financial situations—especially self-employed individuals, high-income earners, or anyone claiming significant or unusual deductions—the value proposition shifts. The potential costs, both financial and emotional, of navigating an IRS audit or recovering from identity theft can be substantial. In these cases, the $49-$69 price tag for TurboTax MAX starts to look like a reasonable investment in peace of mind and professional advocacy.

Before clicking "add to cart," take a moment to honestly evaluate your tax situation, your personal anxiety about audits and identity theft, and whether you truly need the robust level of protection that MAX provides. This careful TurboTax Max Pricing & Value Analysis will empower you to make the decision that's truly right for your wallet and your peace of mind, ensuring you're only paying for the protection you genuinely need. For a deeper dive into making the final choice, consider if TurboTax Max is worth it by reviewing your personal risk factors once more.