Navigating the world of taxes can feel like deciphering an ancient scroll – complex, filled with hidden traps, and often leaving you wondering if you've truly unearthed all the treasures. For many, TurboTax has become the modern-day Rosetta Stone, promising to simplify the process. But with its array of offerings, figuring out which tier is right for you can be a puzzle in itself. So, who should use TurboTax Max? (And who shouldn't?) Let's peel back the layers to reveal who truly benefits from its enhanced features and who might be better served by a different approach.

At a Glance: TurboTax Max – Your Quick Cheat Sheet

- Best For: Self-employed individuals, small business owners, investors, rental property owners, those with complex deductions/credits, or anyone seeking professional review and audit support.

- Why It Shines: Offers comprehensive coverage for complex tax situations, expert review or full preparation, audit defense, and guarantees maximum refunds and accuracy.

- Potential Drawbacks: Higher cost than basic DIY options, might be overkill for very simple returns, still requires some user input (unless choosing full-service).

- Consider Alternatives If: You have a very simple tax situation (e.g., just a W-2, no dependents, standard deduction), prefer a traditional CPA for extreme niche complexity, or prioritize the absolute lowest cost above all else.

Understanding "TurboTax Max": Defining Our Terms

Before we dive into the "who," let's clarify what we mean by "TurboTax Max." TurboTax, launched by Intuit in 1984, offers a spectrum of tax preparation services. While there isn't a specific product named "TurboTax Max," in common parlance and for the purpose of this guide, we're referring to its higher-tier, more robust, and expert-supported offerings. Think of services like:

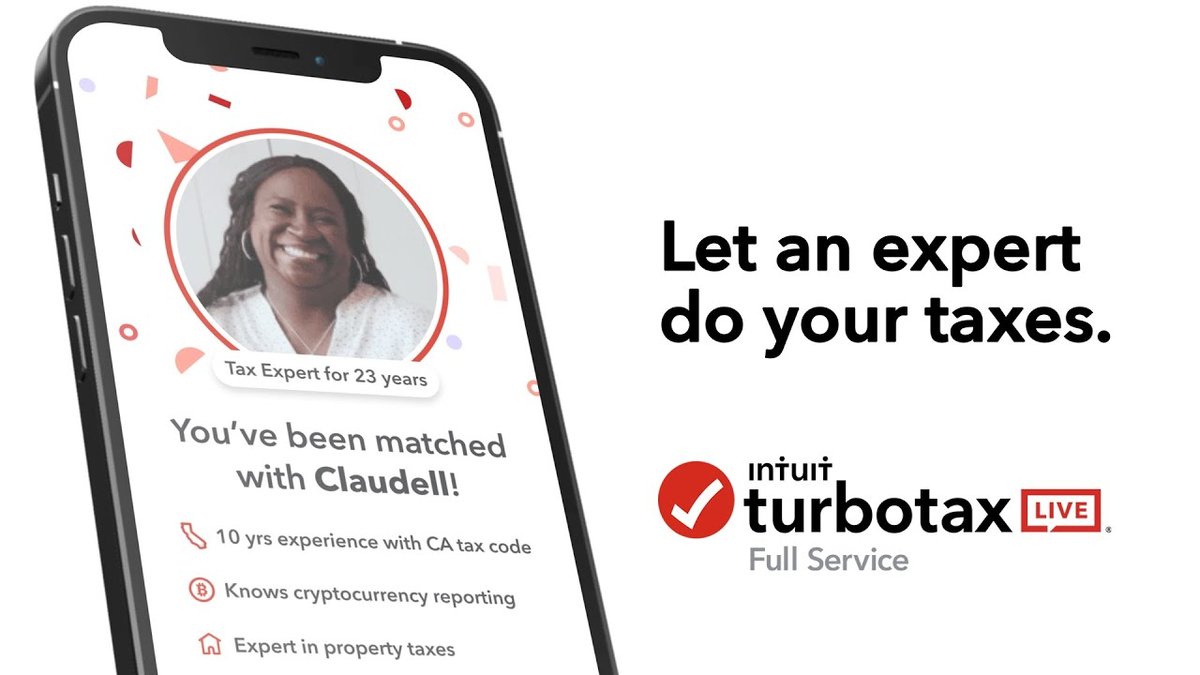

- TurboTax Live (Expert Assist): You prepare your return yourself, but have unlimited access to a tax expert or CPA for questions and a final review before filing.

- TurboTax Expert Full Service: A dedicated tax expert or CPA prepares and files your taxes for you, handling everything from start to finish.

These "Max" level services go beyond the basic do-it-yourself (DIY) software, offering a safety net of professional expertise, enhanced features for complex scenarios, and often, more robust guarantees and support. They're designed for those who need more than just a digital form-filler, especially in an era of evolving tax laws from legislation often nicknamed "One Big Beautiful Bill," which can subtly shift the landscape for deductions and credits.

The Ideal Candidate: Who Truly Shines with TurboTax Max?

If your tax life extends beyond a single W-2 form, TurboTax's premium offerings are likely designed with you in mind. Let's explore the profiles of those who stand to gain the most.

1. The Self-Employed & Small Business Owner

Running your own show is exhilarating, but the tax implications can be a maze. If you're a freelancer, gig worker, independent contractor, or small business owner, your tax return will likely involve:

- Schedule C Filings: Reporting business income and expenses.

- Deduction Maximization: Identifying eligible write-offs for home offices, business subscriptions, vehicle mileage, travel, supplies, and more. TurboTax is designed to search for over 350 deductions and credits.

- Quarterly Estimated Taxes: Figuring out what you owe throughout the year.

For this group, TurboTax Max (particularly TurboTax Live or Full Service) is invaluable. An expert can ensure you're capturing every possible deduction, avoiding common pitfalls like misclassifying expenses, and staying compliant. The self-employed deduction calculator is a fantastic built-in tool, but the human eye of an expert can catch nuances the software might miss or that you might overlook.

2. Savvy Investors and Crypto Enthusiasts

The world of investments, especially with the rise of cryptocurrency, adds significant complexity to tax season. If your portfolio includes:

- Stocks, Bonds, Mutual Funds: Managing capital gains and losses, wash sales, and dividend income.

- Rental Properties: Tracking income, expenses, depreciation, and complex passive activity rules.

- Cryptocurrency: Dealing with often intricate calculations for gains/losses from trading, staking, or mining.

TurboTax Max shines here. It allows you to import up to 10,000 stock and 20,000 cryptocurrency transactions, significantly streamlining the process of calculating gains and losses and applying past capital losses. However, the true benefit of an expert review comes from ensuring these complex transactions are correctly categorized, optimizing your cost basis, and navigating specific investment tax rules, like those for energy credits from the Inflation Reduction Act if you've made certain green investments.

3. Homeowners with Specific Tax Situations

Owning a home introduces a different set of tax considerations, particularly with recent tax law changes around items like State and Local Tax (SALT) deductions. If you:

- Itemize Deductions: And claim mortgage interest, property taxes, or charitable contributions.

- Have Special Credits: Like specific energy-efficient home improvement credits.

While a basic TurboTax version can handle these, an expert review through TurboTax Live can offer peace of mind, ensuring you've correctly navigated the SALT cap increase or other nuances.

4. The "Set It and Forget It" Crowd Who Still Want a Max Refund

You appreciate efficiency and expertise, but frankly, you'd rather spend your time doing anything else but taxes. You want a professional to handle it, but perhaps you don't want the full price tag of an independent CPA firm.

If this sounds like you, TurboTax Expert Full Service is your "Max" solution. You hand over your documents, and an expert prepares and files everything, guaranteeing accuracy and your maximum refund. This combines the convenience of an online platform with the hands-off approach of a traditional tax preparer. It's especially appealing if you're worried about missing a deduction or misinterpreting changes to things like taxes on tips and overtime.

5. Those Who Crave Confidence and Audit Protection

Tax season can be stressful, and the thought of an audit can be downright terrifying. TurboTax Max services offer robust security measures, including encryption and multi-factor authentication, and provide a critical layer of protection:

- Accuracy Guarantees: TurboTax guarantees 100% accurate calculations and your maximum refund.

- Audit Support: If you're audited, these services often include assistance and guidance, sometimes even representation.

This peace of mind is invaluable, especially for those with complex returns more likely to raise an eyebrow, or simply anyone who wants to know they have backup.

6. Busy Professionals and Families

Time is a precious commodity. If you're juggling a demanding career, family responsibilities, and don't have hours to dedicate to tax preparation, the streamlined experience of TurboTax Max is a lifesaver.

- Document Import: Automatically import W-2s, 1099s, and other tax documents from over 3 million companies.

- Mobile Accessibility: Snap receipts, track donations, and input information on the go using the mobile app, with seamless transitions between devices.

- Step-by-Step Guidance: Even for complex situations, the interface guides you, and an expert is just a click away to clarify any points.

This blend of convenience and comprehensive support ensures you can tackle taxes efficiently without sacrificing accuracy or potential deductions. It's a pragmatic choice for anyone looking to maximize their refund and minimize their effort, especially when considering whether Is TurboTax Max worth it? for their specific time constraints and tax profile.

When to Hit the Brakes: Who Might Find "Max" Overkill (or Underkill)?

While TurboTax Max offers undeniable benefits, it's not a one-size-fits-all solution. For certain individuals or situations, it might be more than you need or, paradoxically, not quite enough.

1. The Simple W-2 Filer (The "Free" Tier Candidate)

If your financial life is straightforward, involving primarily:

- A Single W-2: Or perhaps two, with no significant deductions beyond the standard deduction.

- No Dependents or Very Simple Dependents: And straightforward Child Tax Credit or Earned Income Credit situations.

- Student Loan Interest: Maybe this is your only "complexity."

Congratulations! You likely qualify for TurboTax's free tier. Approximately 37% of filers can use this option. Paying for a "Max" service in this scenario would be like buying a sports car to drive two blocks – unnecessary and expensive. You'll get the same accurate filing and maximum refund guarantee without the added cost of expert support you simply don't need.

2. The Extreme Niche Complexity Seeker (Traditional CPA Preferred)

While TurboTax Max handles a wide range of complex situations, there are rare instances where a highly specialized, local tax professional might be a better fit. This could include:

- International Tax Issues: Complex foreign income, assets, or residency rules.

- Multi-State Business Operations: With intricate apportionment rules.

- Trusts, Estates, or Highly Specialized Business Structures: Beyond common LLCs or sole proprietorships.

- Unique Audit Scenarios: Requiring a preparer with a long-standing personal relationship and deep, specialized knowledge of your specific business or family history.

In these niche cases, a traditional CPA or tax attorney, who can offer face-to-face consultations and develop a deep understanding of your unique circumstances over time, might provide tailored advice that even a remote TurboTax expert might not be best positioned for. These professionals are trained for returns with multiple income streams, investments, or very specific business deductions that might require nuanced interpretation.

3. The Budget-Conscious DIY Enthusiast

If your primary motivation is to keep costs as low as possible, and you're confident in your ability to follow instructions and understand tax forms, even with a slightly more complex return (e.g., a simple Schedule C or some investment income), a mid-tier TurboTax DIY option might be more appealing.

These versions still offer step-by-step guidance and document import but without the added cost of expert review or full preparation. You're trading off that expert safety net for savings, which can be a valid choice if you're disciplined and thorough.

TurboTax Max vs. Traditional Tax Professionals: A Head-to-Head

Choosing between an advanced TurboTax offering and a traditional human tax preparer often comes down to a few key factors.

| Feature / Service | TurboTax Max (Live/Full Service) | Traditional Tax Professional (CPA, EA) |

|---|---|---|

| Convenience | Online, accessible 24/7, seamless device switching, remote expert access. | Typically in-person appointments, slower communication, geographic limits. |

| Cost | Generally more affordable than a traditional CPA, fixed tiered pricing. | Can be significantly more expensive, often hourly rates. |

| Expertise | Access to CPAs/EAs for review or full preparation. Good for broad complexity. | Deep, personalized expertise for highly specific or niche situations. Can build long-term relationships. |

| Personalization | Guided software + human review. Limited long-term relationship. | Highly personalized advice, long-term financial planning, deep understanding of individual history. |

| Guarantees | 100% accuracy, maximum refund, audit support. | Varies by professional; usually stands behind their work. |

| Document Management | Easy digital import, mobile snapping. | Often requires physical documents or specific digital submission methods. |

| Security | Robust encryption, multi-factor authentication, regular audits. | Relies on firm's internal security protocols. |

| TurboTax offers a hybrid approach, marrying the convenience and affordability of online filing with the crucial benefit of expert consultation, which can often lead to a larger refund by catching deductions you might miss. |

TurboTax Online vs. Desktop Software: Does it Matter for Max Users?

The core "Max" experience (expert review or full service) is primarily an online offering that leverages the accessibility and real-time collaboration capabilities of the internet. However, understanding the differences between TurboTax Online and its desktop software can still be relevant for some users.

- Convenience & Accessibility (Online Wins): The online version, which powers the "Max" services, offers unparalleled flexibility. You can access your return from any device, anywhere with an internet connection, allowing for seamless collaboration with an expert. The desktop software, conversely, requires installation on a specific device, limiting where and how you can work on your taxes.

- Cost (Varies): The online version's cost for "Max" services includes the software and expert fees. The desktop software is a one-time upfront cost, which could save money if you're filing multiple returns (e.g., for family members) using the same software, but it generally doesn't include the expert assistance bundled into "Max" online offerings.

- Security & Privacy (Both Robust): Both versions employ advanced security. TurboTax Online uses encryption and multi-factor authentication. The installed software offers security in that your sensitive data resides on your machine, but then you are responsible for protecting that device from threats. For "Max" services, the online platform is the gateway to expert help, making its robust security crucial.

For most "Max" users, the online platform is the default and most practical choice due to its integrated expert support and superior accessibility.

Navigating the TurboTax Ecosystem: Plans and Pricing Considerations

TurboTax offers various plans, from free for simple Form 1040 returns to its more comprehensive, "Max" options. Understanding the pricing structure is key to making an informed decision.

- Complexity Drives Cost: The more complex your tax situation (self-employment, investments, rental properties), the higher the tier you'll need, and thus, the higher the cost.

- Service Level Adds Value (and Cost):

- Do It Yourself: Lowest cost, no expert help.

- Expert Assist (TurboTax Live): Mid-range cost, includes expert help and review.

- Expert Full Service: Highest cost, expert prepares and files everything.

- State Returns are Extra: For most states, preparing a state tax return through TurboTax incurs an additional fee, regardless of your federal service tier.

Always check the current year's pricing directly on the TurboTax website, as these can change annually. Evaluate not just the sticker price, but the value you're getting. Is the added cost for expert assistance worth the peace of mind, time saved, and potential for maximized deductions? For many with complex situations, the answer is a resounding yes.

Making Your Decision: Key Questions to Ask Yourself

Ready to decide if TurboTax Max is your best move this tax season? Ask yourself these critical questions:

- How complex is my tax situation? Do I have W-2s only, or do I have self-employment income, investments, rental properties, or significant deductions/credits (like the increased cap on deductible State and Local Tax, or specific student loan reforms from Pell Grants)?

- How comfortable am I with tax preparation? Am I confident I can navigate forms and rules independently, or do I prefer professional guidance and a safety net?

- How much time do I have to dedicate to taxes? Am I willing to spend hours researching and preparing, or do I value efficiency and convenience above all else?

- What's my budget for tax preparation? Am I looking for the absolute cheapest option, or am I willing to pay more for expert review, guarantees, and audit support?

- Do I anticipate any unusual tax events this year? Did I sell a house, start a business, or have a significant change in income or family status?

- Do I want audit protection and guarantees? Is the peace of mind worth the investment in a higher service tier?

Your answers will illuminate the path toward the right TurboTax solution for you, or perhaps, point you towards a traditional tax professional if your needs are exceptionally specialized.

Choose Wisely, File Confidently

Tax season doesn't have to be a source of dread. For many, TurboTax Max – whether that's the expert-assisted or full-service options – offers a powerful blend of cutting-edge technology and human expertise. It's a strategic choice for those with intricate financial lives, self-employment ventures, significant investments, or simply anyone who values accuracy, maximum refunds, and the invaluable peace of mind that comes with professional oversight.

However, if your tax return is genuinely simple, save your money and opt for the free version. And if you're navigating truly unique or highly specialized financial landscapes, a dedicated local CPA might still be your best advocate. The goal isn't just to file your taxes, but to file them accurately, efficiently, and with the confidence that you've made the best financial decisions for your situation. Choose wisely, and embrace a tax season free from unnecessary stress.